Reactivating Drop-Offs: The Missing Voice Layer in Loan Journeys using AI Voice Agents

.webp)

Every fintech team knows the pain of user drop-offs. You’ve optimized your ads, tuned your onboarding flow, A/B tested every CTA. Still, users click, explore and suddenly, they disappear. For journeys like loan applications, it’s quite common and predictable. However, instead of just sending another re-engagement push notification, what if there was another fix? A conversation in the user’s own language, at the right time, with the right tone?

The Silent Failure Point in Loan Funnels

Loan applications are complex. Interest rates, eligibility criteria, repayment terms - even the best-designed apps can leave users confused. Yet, most re-engagement strategies rely on passive nudges: SMS, WhatsApp, or app push notifications. These rarely address the root of user hesitation.

In contrast, one leading digital lending platform in India found that AI voice calls placed at key drop-off moments, drove a 10-15% lift in completed loan applications.Just natural, human-sounding voice agents trained to answer common questions, explain terms, and nudge users back into the funnel.

“We realized users weren’t dropping off because of disinterest,” said one product stakeholder.

“They were unsure about interest rates or document requirements - and nobody was there to explain.”

Where the Drop-Off Really Happens

The critical moment is often right after ad engagement but before app install. A user clicks an ad, shows intent, maybe even submits details - but never completes onboarding.

This is the gap that most digital lenders are trying to close. Traditional follow-ups like WhatsApp messages or emails often get ignored. In contrast, a well-timed voice call feels personal, proactive, and respectful of the user’s intent.

And if that call is handled by an AI voice agent - one that understands the user’s language, context, it becomes scalable.

The Case for Voice in Lending: Not Just Any Voice

To make voice agents effective in loan journeys, a few things must be true:

1. They must sound natural

Users quickly disengage from robotic or “flat” voices. In India especially, tonal variation, filler words, and pacing signal authenticity.

Lenders found that using regional tonality like subtle hesitation and code-switching dramatically improved user trust.

2. They must speak the right language

India’s linguistic diversity isn’t optional. Borrowers in Bengaluru prefer Kannada. Users in Patna expect Hindi. In Chennai, English often reduces clarity, not enhances it. When it comes to speaking in regional languages, code-switching is often used. It is very common to speak multiple languages in the same sentence.

That’s why support for at least 10 Indian languages (and dialectal flexibility) is no longer a nice-to-have, it’s essential for nationwide lending use cases.

3. They must know when not to speak

In regulated domains like lending, hallucinated answers can cause a break in the conversation. A smart voice agent should gracefully defer:

“I’m not sure about this. Let me connect you with our support team for more information.”

Murf Falcon: Ultra-Fast, Low Latency TTS Model to Build Voice Agents

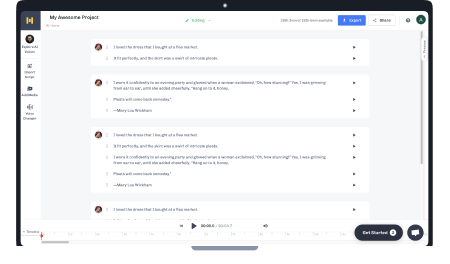

Murf Falcon is a voice AI platform built specifically for high-stakes, multi-turn voice interactions. It enables fintech teams to programmatically deploy AI voice agents that sound natural, stay compliant, and scale with demand.

Here’s how Murf Falcon is uniquely suited for solving drop-offs in loan funnels:

Built for Re-Engagement at Scale

When building AI voice agents, users can use Murf Falcon to re-engage a pool of their dormant prospects. Using Falcon’s automated voice outreach, they were able to contact users who had clicked an ad but never made it through the full signup flow. This could help them scale rapidly with personalized follow-ups using a natural-sounding voice, keeping costs predictable and low. Using campaigns, they can also set up multiple conversational touchpoints. Imagine re-engaging 5000+ users at a much lower cost - that included TTS, LLMS and telephony expenses.

The goal? Reconnect with users who dropped off between ad click and app install. The result? A measurable uptick in application completions and more insight into where and why users stall.

Regional Voice Support with Realism

Murf Falcon supports over 10 Indian languages, including Hindi, Tamil, Telugu, Kannada, Marathi, Bengali, and more. The platform has code-mixing possibilities, and focuses on tonality and conversational realism, adding filler words, asymmetry, and emotional cadence to mimic real human speech.

With data residency in India, Murf’s latency is faster than industry standards when it comes to building responses for real-time voices.

Built-in Compliance & Guardrails

In voice agents for finance, safety is non-negotiable. Murf Falcon includes:

- LLM Guardrails: Agents are trained to defer when unsure - no guessing, no hallucinations.

- Data Residency in India: Fully compliant with RBI-mandated data policies.

- Enterprise Security: Support for NDAs, internal sandbox testing, and sensitive workflows.

For lending teams, this means faster deployment without legal risk.

Easy Pilots, Clear Metrics

Murf Falcon encourages pilot-driven onboarding. One lending partner could begin with, depending on their requirements:

- 5,000 - 10,000 users over 30 days

- Success metrics: App downloads, loan starts, call duration, and conversion

- Collaborative setup: Integration with customer knowledge bases, custom call flows, and shared dashboards

- No upfront licensing: Usage-based pricing to prove value before scaling

Why Voice? Why Now?

The Indian lending ecosystem is entering a new phase: high CAC, fragmented user journeys, and a growing need to personalize at scale. Voice - especially AI-powered, programmable voice - offers a way to:

- Reconnect with users who've shown interest

- Explain and clarify without pressure

- Nudge drop-offs back into the funnel

- Do all this without adding call center headcount

This isn’t about replacing human touch. It’s about scaling it without diluting the nuance that builds trust.

Why Murf Falcon?

To sum up, If you're building AI voice agents for regulated, multilingual, high-stakes environments, here’s what sets Murf Falcon apart:

Learn more at murf.ai/falcon

Every digital lender has drop-offs. But not every lender gets a second chance to re-engage those users - in the right voice, at the right time.

With Murf Falcon, that second chance sounds a lot more human.

.webp)

.webp)